Will my property taxes go up?

Will my property taxes go up?

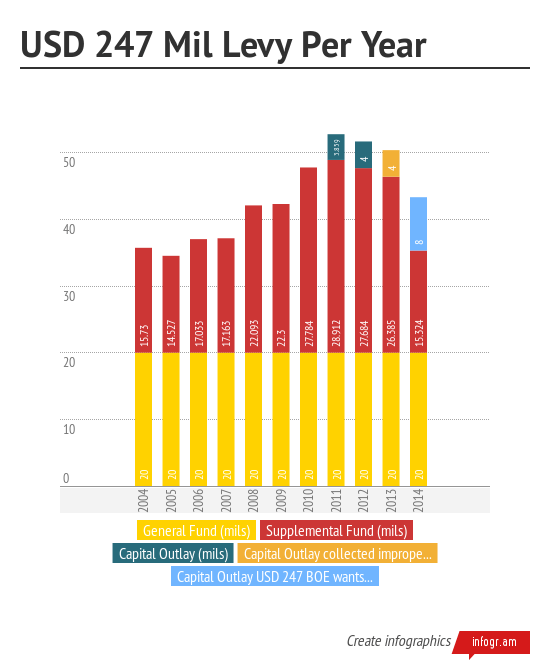

No, for the third year in a row property taxes going towards education are decreasing. Even if the authority to collect Capital Outlay is approved by voters, the Total Mil Rate still drops compared to previous years.

If the Capital Outlay passes, precedent exists that money collected improperly in 2013-2014 could be credited to taxpayers in 2014-2015.

Is it true Capital Outlay is at zero mils right now?

Technically, yes. While 4 mils was collected by mistake due to a clerical mistake last year, in previous years the district has collected 4 mils as authorized. Again, last year’s was not certified due to an error, thus voiding the 4 mils believed to be in place, making the current Capital Outlay rate 0 mils.

What will the tax be if Capital Outlay authorization passes?

The drop in school taxes collected for a property owner within USD 247 depends on the assessed value of their property. This IS NOT the sell value of the property. The county appraiser determines an appraised value for your property and then the treasurer’s office applies an assessed value. The taxes you pay are the assessed value multiplied by the mil levy.

NOTE: The first year the tax improperly collected in 2013-2014 would most likely be credited, effectively making 2014-2015 a 4 mil rate.

| Collected in 2013-2014 | 2014-2015 With 8 Mils Capital Outlay | 2014-2015 with Capital Outlay at 4 mils (as recently collected) | Difference

(Annual) |

Difference

(Per Month) |

|

|---|---|---|---|---|---|

| Total Mil Rate for USD 247 | 50.385 mils | 43.324 mils | 39.324 mils | 4 mils | |

| $25,000 Appraised Residential | $144.85 | $124.55 | $113.05 | $11.50 | $0.96 |

| $50,000 Appraised Residential | $289.71 | $249.11 | $226.11 | $23.00 | $1.92 |

| $100,000 Appraised Residential | $579.42 | $498.22 | $452.22 | $46.00 | $3.83 |